Ever feel like your money is just… vanishing? Like you’re on a never-ending hamster wheel, working hard but never quite getting ahead? I get it. Been there, stressed about that. That’s where the 50/30/20 budget can be your secret weapon. Seriously, it’s simpler than it sounds and way more effective than you might think. 🎯

What the Heck *Is* the 50/30/20 Budget, Anyway? 🤔

Okay, let’s break it down. Imagine dividing your after-tax income (that’s the money you actually *see* in your bank account) into three simple buckets:

- 50% for Needs: These are your essentials. Think rent/mortgage, utilities, groceries, transportation, insurance, minimum debt payments – basically, the stuff you *have* to pay for to survive. 🏠

- 30% for Wants: This is where the fun starts! Dining out, entertainment, hobbies, that new gadget you’ve been eyeing, subscriptions… basically, the stuff that makes life enjoyable, but isn’t strictly essential. 🍕

- 20% for Savings and Debt Repayment: This is the key to future you thanking present you. This bucket is for building your emergency fund, investing for retirement, paying down high-interest debt (credit cards, personal loans), and achieving other financial goals. 💰

It’s a guideline, not a rigid rule. The beauty of the 50/30/20 budget is its simplicity and flexibility. It gives you a framework, but allows you to adjust it based on your own priorities and circumstances. Think of it like a recipe – you can add your own spices to make it just right!

50/30/20 Monthly Budget Spreadsheet

50/30/20 Monthly Budget Spreadsheet ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Why the 50/30/20 Budget Rocks (And Why You Should Care!) 🌟

Alright, why should you ditch your current budgeting method (or lack thereof) and hop on the 50/30/20 bandwagon? Here’s the deal:

- Simplicity: No complicated spreadsheets or confusing categories. Three simple buckets make it easy to track your spending. 🙌

- Flexibility: It’s not a one-size-fits-all. Adjust the percentages to fit your lifestyle and goals. Need to aggressively pay down debt? Bump up the 20% category. Want to save for a big vacation? Tweak the “wants” and “savings” categories accordingly. 🏖️

- Balanced Approach: It allows for both enjoying life *now* and planning for the future. You’re not depriving yourself entirely, which makes it more sustainable in the long run. Let’s face it, if a budget is too restrictive, you’re just going to ditch it. 🙅♀️

- Awareness: It forces you to really *look* at where your money is going. This awareness alone can lead to better spending habits. It’s like shining a spotlight on your financial behaviors. 💡

50/30/20 Annual Budget Planner

50/30/20 Annual Budget Planner ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

The 50/30/20 Budget Rules: Let’s Get Down to Brass Tacks 🔨

While the concept is simple, there are a few ground rules to keep in mind to make sure you’re actually *using* the 50/30/20 budget effectively.

- Calculate Your *After-Tax* Income: This is crucial. You can’t budget money you don’t actually receive. Check your pay stub to see your net pay (after taxes and deductions).

- Track Your Spending (Honestly!): You can’t allocate your income properly if you don’t know where it’s going. Use a budgeting app, spreadsheet, or even a good old-fashioned notebook to track your expenses for a month or two. ✍️

- Categorize, Categorize, Categorize: Be honest with yourself about whether something is a need, a want, or savings/debt. It’s tempting to justify that fancy coffee as a “need,” but let’s be real, it’s a want. ☕

- Prioritize Debt: High-interest debt (credit cards) should be a top priority in your “20%” category. The sooner you pay it off, the more money you’ll free up in the long run. 🔥

- Review and Adjust Regularly: Life changes. Your budget should too. Review your 50/30/20 allocation monthly and adjust as needed based on your goals and circumstances. 🔄

50/30/15/5 Monthly Budget Planner

50/30/15/5 Monthly Budget Planner ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Practical Tools & Implementation: Making It Work for *You* 🛠️

Okay, so you’re sold on the idea. Now, how do you actually put the 50/30/20 budget into practice? Here are some tools and techniques to get you started:

The 50/30/20 Budget Worksheet: Your Starting Point 📝

A simple worksheet can be incredibly helpful to visualize your income and expenses and start allocating them to the correct categories. Here’s a basic outline:

- Calculate Your Net Monthly Income: (Income after taxes) $________

- Calculate Your 50% Needs: $________ (0.50 x Net Income)

- Rent/Mortgage: $________

- Utilities: $________

- Groceries: $________

- Transportation: $________

- Insurance: $________

- Minimum Debt Payments: $________

- Other Needs: $________

- Total Needs: $________

- Calculate Your 30% Wants: $________ (0.30 x Net Income)

- Dining Out: $________

- Entertainment: $________

- Hobbies: $________

- Shopping: $________

- Subscriptions: $________

- Other Wants: $________

- Total Wants: $________

- Calculate Your 20% Savings & Debt: $________ (0.20 x Net Income)

- Emergency Fund: $________

- Debt Repayment (Above Minimum): $________

- Investments: $________

- Other Savings Goals: $________

- Total Savings & Debt: $________

Use this outline to create your own worksheet in a notebook or use spreadsheet software like Google Sheets or Microsoft Excel. Don’t worry, we have templates for those, too! Keep reading.

50/30/15/5 Annual Budget Spreadsheet

50/30/15/5 Annual Budget Spreadsheet ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

The 50/30/20 Budget Excel Spreadsheet: Level Up Your Tracking! 📈

While a paper worksheet is great for getting started, an Excel spreadsheet can offer more advanced tracking and analysis capabilities. Here’s what you can include in your spreadsheet:

- Income Tracker: A section to record your income for each month.

- Expense Tracker: Categorize your expenses by “Needs,” “Wants,” and “Savings/Debt.” Use formulas to automatically calculate totals for each category.

- Progress Charts: Create charts to visualize your spending habits and track your progress towards your savings goals. Seeing your progress visually can be a huge motivator. 📊

- Customizable Categories: Customize the categories within each bucket to match your specific needs and spending habits.

You can find tons of free 50/30/20 budget Excel templates online (just search “50/30/20 budget Excel template”). Or, if you’re feeling ambitious, you can build your own!

Income and Expense Tracker Spreadsheet

Income and Expense Tracker Spreadsheet ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

The 50/30/20 Budget Templates: Your Jumpstart to Success 🚀

Want to skip the hassle of creating your own worksheet or spreadsheet from scratch? We’ve got you covered! Many websites (including ours! – *hint, hint*) offer free 50/30/20 budget templates that you can download and customize. Look for templates that are:

- Easy to use: The interface should be intuitive and user-friendly.

- Customizable: You should be able to adjust the categories and percentages to fit your needs.

- Visually appealing: A well-designed template can make budgeting feel less like a chore.

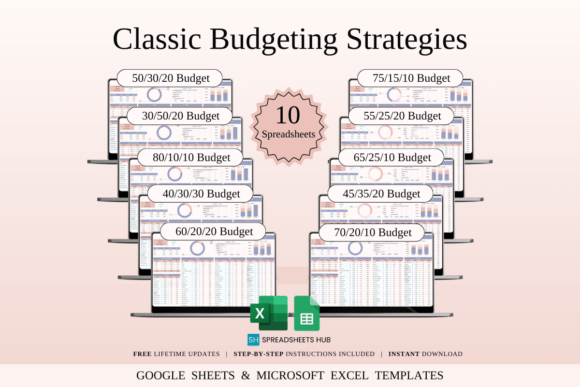

50/30/20 & Alternative Budgeting Methods

50/30/20 & Alternative Budgeting Methods ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Budgeting Apps: Automate Your Financial Life 🤖

If you prefer a more automated approach, consider using a budgeting app. Many apps allow you to connect your bank accounts and credit cards, automatically track your spending, and categorize your transactions. Some popular options include Mint, YNAB (You Need A Budget), and Personal Capital.

When choosing a budgeting app, consider:

- Security: Make sure the app has strong security measures to protect your financial information.

- Features: Look for features that are important to you, such as expense tracking, goal setting, and investment monitoring.

- User interface: Choose an app that you find easy and enjoyable to use.

- Cost: Some budgeting apps are free, while others require a subscription.

Classic Budgeting Strategies in Excel

Classic Budgeting Strategies in Excel ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

50/30/20 Money Saving: Making the Most of Your Resources 💰

The 50/30/20 budget isn’t just about tracking your spending, it’s also about maximizing your savings. Here are some tips for squeezing the most out of that “20%” category:

- Automate Your Savings: Set up automatic transfers from your checking account to your savings account each month. Even small, regular contributions can add up over time. Think of it as paying yourself first! 🏦

- Reduce Your “Wants” Spending: Take a hard look at your “wants” and identify areas where you can cut back. Do you really need that daily latte? Could you find free alternatives to your favorite entertainment? Small changes can make a big difference. ☕➡️💧

- Negotiate Bills: Call your service providers (internet, cable, insurance) and try to negotiate lower rates. You might be surprised at how much you can save. 📞

- Embrace DIY: Learn to do things yourself, such as basic home repairs, car maintenance, or cooking from scratch. The internet is your friend here. YouTube is a treasure trove! 🔨

- Use Coupons and Discounts: Take advantage of coupons, discounts, and cashback rewards whenever possible. It’s like finding free money! 💸

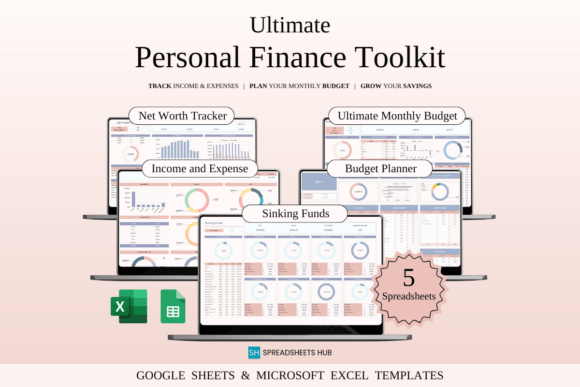

Ultimate Personal Finance Toolkit

Ultimate Personal Finance Toolkit ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

50/30/20 Financial & Budgeting Aspects: Beyond the Numbers 🤓

The 50/30/20 budget is a great tool, but it’s important to understand the broader financial context. Here are some related financial and budgeting aspects to consider:

- Setting Financial Goals: What do you want to achieve with your money? Do you want to buy a house? Retire early? Travel the world? Setting clear financial goals will help you stay motivated and focused on your budget. Set SMART goals: Specific, Measurable, Achievable, Relevant, and Time-bound. 🎯

- Building an Emergency Fund: An emergency fund is essential to protect yourself from unexpected expenses, such as job loss or medical bills. Aim to save 3-6 months’ worth of living expenses in a readily accessible account. ☔

- Investing for the Future: Once you have an emergency fund, start investing for retirement. Consider opening a 401(k) or IRA and investing in a diversified portfolio of stocks and bonds. 📈

- Understanding Credit: Your credit score plays a major role in your financial life. Pay your bills on time and keep your credit utilization low to maintain a good credit score. Check your credit report regularly for errors. 💳

- Seeking Professional Advice: If you’re struggling to manage your finances or achieve your financial goals, consider seeking advice from a qualified financial advisor. A good advisor can provide personalized guidance and help you create a comprehensive financial plan. 👨💼

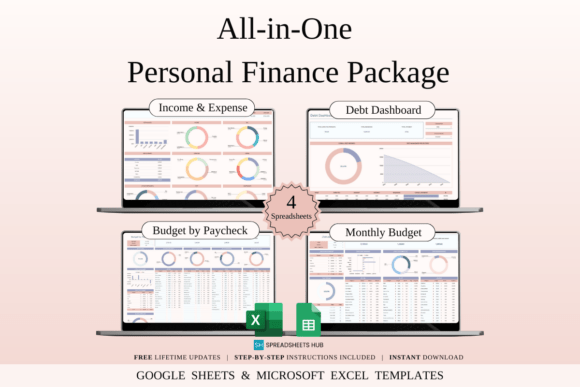

All-in-One Personal Finance Package

All-in-One Personal Finance Package ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Is 50/30/20 for you? Potential Challenges and How to Overcome Them

The 50/30/20 budget, while incredibly popular and simple, is not without its own potential speedbumps. Here’s a quick look at some challenges and, more importantly, *how* to deal with them.

- Low Income. Sometimes, 50% for Needs just isn’t enough to cover everything.

*Solution:* Identify absolutely *essential* expenses and cut mercilessly. Think about things like meal planning to avoid costly take-out or looking at more affordable housing options. Side hustles could be a necessity here. - High Debt. Same situation. That 20% doesn’t even make a dent in your debt avalanche.

*Solution:* Seriously explore options like balance transfers with lower interest rates. Create a realistic debt repayment plan. Automate even small payments to ensure consistency. - Unexpected Expenses. Car repairs. Doctor’s bills. Life throws curveballs, and that can blow your budget apart.

*Solution:* That Emergency Fund is non-negotiable! Resist dipping into other categories, like “Wants,” to make it a habit. - Overspending on “Wants.” Be honest with yourself; those lattes really add up.

*Solution:* Track, Track, Track! Many budgeting apps and spreadsheets help with this. Maybe implement a ‘no-spend’ weekend once a month for a conscious check. - Lack of Discipline. Life happens. Consistency can be tricky.

*Solution:* Visual reminders – write your goals down and put them everywhere! Set achievable micro-goals to keep you on track, like automating one small savings task per week to boost momentum. Also find a budgeting buddy! A friend to check-in with and celebrate those small milestones together for accountability.

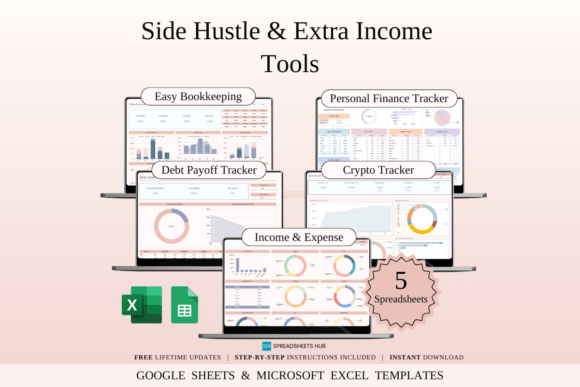

Side Hustle & Extra Income Tools | Excel

Side Hustle & Extra Income Tools | Excel ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Conclusion: Take Control of Your Money Today! 🎉

The 50/30/20 budget is more than just a set of numbers; it’s a framework for creating a healthier and more fulfilling financial life. It’s about being intentional with your money, making conscious choices, and building a brighter future. So, ditch the financial stress, embrace the simplicity of the 50/30/20 rule, and start building your financial freedom today!

Ready to dive deeper and access our free 50/30/20 budget templates? Visit our website to download your template and start taking control of your money!