Hey there, money-savvy reader! 👋 Let’s be honest, debt can feel like a heavy anchor dragging you down, right? It lurks in the back of your mind, a constant hum of financial stress. But what if I told you there’s a way to not just manage it, but to conquer it, to banish it from your life forever? Sounds good, doesn’t it? Well, you’ve landed in just the right place! We’re about to dive deep into the world of debt tracking and payoff strategies, equipping you with the ultimate toolkit to regain control and march triumphantly towards a debt-free future. Think of this as your personal bootcamp for banishing debt – no more hiding under the covers when the bills arrive! Let’s get real about your money, map out your journey, and empower you to reclaim your financial peace of mind. Are you ready to flip the script on your debt? Let’s go!

Why Bother Tracking Your Debt? Understanding General Debt Tracking Tools 🤔

Before we even get to the “how,” let’s chat about the “why.” You might be thinking, “My bank statements tell me what I owe, isn’t that enough?” And while technically true, just *knowing* the number is like trying to navigate a dark maze with only a flicker of light – you can see what’s directly in front of you, but you have no real sense of the overall path or the traps ahead. This is where general debt tracking tools come into play. They aren’t just about recording numbers; they’re about gaining a profound understanding of your financial landscape. They’re about visibility, strategy, and accountability. Without a clear picture, how can you formulate an effective battle plan? You can’t just throw money at your debts willy-nilly and hope for the best – that’s a recipe for frustration, not freedom!

A good debt tracker is like a financial GPS. It shows you exactly where you are, points out all your liabilities (those credit cards, student loans, car payments), maps out your progress, and guides you towards your ultimate destination: financial independence. It allows you to:

- See all your debts in one place: No more jumping between different logins and statements.

- Track interest rates and minimum payments: Essential information for smart payoff strategies.

- Monitor your progress over time: There’s nothing more motivating than seeing that principal balance shrink! 📉

- Identify areas where you can optimize your payments: Are you throwing too much at a low-interest debt when a high-interest one is eating you alive?

- Stay motivated and accountable: When you visualize your progress, it fuels your determination to keep going.

From a simple pen-and-paper list to sophisticated software, the fundamental goal of these tools remains the same: to empower you with clarity and control. Let’s explore the various options available, because trust me, there’s a perfect fit out there for everyone!

Debt Payoff Tracker Spreadsheet

Debt Payoff Tracker Spreadsheet ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

The Digital Dynamo: Excel-Based Digital Debt Trackers 📊

If you’re looking for a powerful yet customizable tool that won’t cost you a dime, then setting up an Excel-based digital debt tracker is often your first and best bet. Think of Excel as a blank canvas for your financial masterpiece! You have complete freedom to design it exactly how you want it, making it as simple or as complex as your heart (and your debt situation) desires. Plus, for many, the very act of building the spreadsheet is an exercise in mindfulness, forcing you to confront and organize your financial reality. It’s like designing your own personalized fitness tracker for your finances.

What Makes an Amazing Excel Debt Tracker?

A really good Excel tracker will usually include several key columns for each debt:

- Creditor Name (e.g., “Visa,” “Student Loan Servicer”)

- Current Balance: This is the big one that changes over time!

- Original Balance: A great way to visualize how far you’ve come.

- Interest Rate (APR): Crucial for prioritizing higher-interest debts.

- Minimum Monthly Payment: What you absolutely must pay.

- Due Date: So you never miss a payment and incur late fees.

- Last Payment Made: For historical tracking and peace of mind.

- Date Paid Off (if applicable): The glorious day you reach debt freedom! 🥳

But don’t stop there! Get fancy! Add columns for additional payments, formulas to calculate projected payoff dates based on your payments, or even a section to track your “debt snowball” or “avalanche” progress (we’ll talk more about those strategies soon!). The beauty of Excel is its versatility. You can use conditional formatting to highlight debts that are nearly paid off, create pivot tables to summarize your debt by type, or even embed charts to visually represent your debt reduction over time. Imagine a pie chart shrinking as your principal disappears – incredibly satisfying! While it takes a little setup initially, the long-term benefits of a robust Excel tracker are immense. It becomes a living document of your journey to financial freedom.

Debt Tracker Spreadsheet Template Excel

Debt Tracker Spreadsheet Template Excel ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Stepping Up Your Game: Debt Tracker – Advanced Digital Platforms 🌐

For those who crave automation, sleek interfaces, and integration with other financial tools, advanced digital platforms designed specifically for debt tracking can be game-changers. These aren’t just glorified spreadsheets; they often come packed with features that can automate the tedious parts of tracking, offer deeper insights, and even suggest personalized strategies. Think of them as your personal financial assistant, tirelessly crunching numbers in the background so you don’t have to.

Beyond Basic Tracking: What Advanced Platforms Offer

Many of these platforms can securely link to your bank accounts, credit cards, and loan servicers, pulling in real-time data to keep your balances accurate. This means less manual entry and more time focusing on *paying down* that debt! They often provide:

- Automated balance updates: No more manually entering every payment.

- Visual dashboards and progress reports: Graphs and charts that show your debt decreasing, projected payoff dates, and interest saved. Seeing your debt go down visually is a huge motivator! 📈

- Debt payoff calculators: Tools to simulate different payment scenarios and show you the fastest or cheapest way to eliminate debt.

- Budgeting integration: Many platforms combine debt tracking with comprehensive budgeting features, giving you a holistic view of your finances.

- Personalized recommendations: Some advanced systems use algorithms to suggest the best debt payoff strategy for *your* specific situation.

- Security features: Encryption and robust security protocols to protect your sensitive financial data.

While some of these platforms might come with a subscription fee, the convenience, automation, and powerful insights they offer can be well worth the investment if you’re serious about aggressively tackling your debt. They turn debt management from a chore into a highly engaging and streamlined process.

Debt Payoff Planner & Tracker

Debt Payoff Planner & Tracker ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Debt Trackers: Mobile App & Software-Specific Solutions 📱

In our always-on, always-connected world, mobile app & software-specific debt trackers offer unparalleled convenience. Who doesn’t love having powerful tools right in their pocket? These apps bring the sophisticated features of advanced digital platforms right to your smartphone, allowing you to track your progress, log payments, and stay on top of your debt even when you’re on the go. They transform tedious financial tasks into quick, easy actions.

The Power of Your Pocket: Why Mobile Apps Are a Hit

Imagine waiting in line at the coffee shop and being able to quickly update your debt balance after a payment, or glance at your projected payoff date. That’s the power of mobile apps! They excel at:

- Real-time tracking and notifications: Get alerts when payments are due or when your balance updates.

- Ease of input: Many allow for quick logging of payments or integration with financial institutions for automatic updates.

- User-friendly interfaces: Designed for intuitive use on smaller screens, often with engaging visuals.

- Portability: Your debt tracker is always with you, allowing for spontaneous check-ins and motivation boosts.

- Budgeting & Expense Tracking: Many debt apps are part of broader personal finance suites, linking debt management to your overall cash flow.

Whether you’re into quick data entry on your lunch break or want comprehensive reports at your fingertips, these dedicated apps make debt tracking accessible and actionable, transforming a daunting task into manageable daily check-ins. Just remember to choose an app with a strong reputation for security and data privacy! Your financial details are precious.

Debt Payoff Tracker Excel & Google Sheet

Debt Payoff Tracker Excel & Google Sheet ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Back to Basics: Debt Tracker Printable & Static Format 📝

Hold on a second – in this digital age, are we really talking about paper and pens? Absolutely! Don’t underestimate the humble yet mighty debt tracker printable & static format. For some, the tactile experience of physically writing down numbers, seeing progress on a piece of paper, and coloring in progress bars is incredibly therapeutic and motivating. It’s a disconnect from screens that many people crave. It’s like building something with your own hands – there’s a deeper connection than simply typing numbers.

The Undeniable Charm of Pen and Paper

Printable templates can be found online in abundance, ranging from simple balance sheets to elaborate visual trackers where you color in squares for every $100 paid off. These static formats offer:

- Simplicity and Zero Tech Glitches: No apps to update, no passwords to remember. Just you, your pen, and your numbers.

- Visual Motivation: Many people find immense satisfaction in physically seeing the numbers written down, or in marking off progress on a physical chart. It creates a stronger psychological connection to your goal. 🖍️

- Mindful Engagement: The act of writing can foster a deeper connection to your finances, promoting thoughtful engagement rather than passive observation.

- Accessibility: Anyone with a printer can use these – no fancy software required.

- Customization: While “static,” you can always print out new versions or design your own simple tables to suit your needs perfectly.

While they lack the automation of digital tools, printable debt trackers provide a tangible, always-visible reminder of your goal. Stick it on your fridge, put it in your planner – make it a constant presence in your financial world. It serves as a visual anchor to your debt-free aspiration.

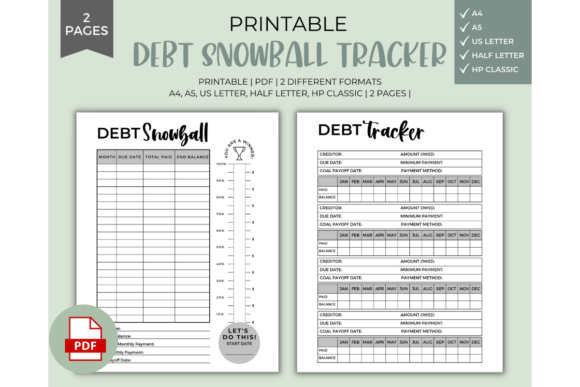

Debt Snowball Tracker

Debt Snowball Tracker ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Personalizing Your Journey: Bullet Journal & Physical Debt Trackers 📓

Taking the static format a step further, the burgeoning world of bullet journaling offers a uniquely personal and creative approach to debt tracking. A bullet journal & physical debt tracker is more than just a template; it’s a living, breathing testament to your financial journey, crafted entirely by your own hand. It’s about combining creativity with personal finance, turning what might feel like a chore into an artistic endeavor that genuinely excites you. If you’re a visual learner, or someone who loves to doodle, this could be your financial sweet spot!

Beyond the Screen: The Art of Tangible Tracking

A bullet journal allows you to design your debt tracking pages with your own flair. You can use colors, stickers, intricate layouts, and motivational quotes. It transforms a numerical goal into a creative project. Imagine drawing a thermometer that slowly fills up as you pay off debt, or a mountain you’re climbing where each peak represents a debt conquered. This approach offers:

- Ultimate Customization: Design pages exactly as you envision them, perfectly aligning with your personal preferences and tracking needs.

- Increased Engagement and Ownership: Because you’ve poured your creativity into it, you’re more likely to consistently use and engage with your tracker. It’s yours, in a way a pre-made app can’t quite replicate.

- Therapeutic Process: The physical act of drawing, writing, and updating can be meditative and stress-reducing, turning financial management into a positive habit.

- No Digital Distractions: When you’re working on your bullet journal, you’re focused purely on your financial goal, without pop-ups or notifications.

- Integration with Life Planning: Bullet journals are often used for general life planning, allowing you to seamlessly integrate your financial goals with your broader aspirations.

Whether it’s a dedicated notebook or a section within your existing bullet journal, the tangibility and personalized nature of these physical trackers can foster a deep, enduring commitment to your debt payoff journey. It makes your financial freedom tangible, piece by beautiful piece.

Debt Payoff Ebook + Workbook

Debt Payoff Ebook + Workbook ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Debt Tracker Strategies: The Snowball Method ☃️

Alright, so you’ve got your awesome debt tracker – whether it’s a fancy app or a hand-drawn masterpiece. Now, what’s the plan for actually getting rid of that debt? This is where strategic debt payoff methods come in, and one of the most popular (and emotionally satisfying!) is the Debt Snowball Method. Imagine rolling a small snowball down a hill; as it picks up more snow, it gets bigger and faster, right? That’s exactly how this strategy works with your debt!

How to Unleash the Snowball

The core idea of the Debt Snowball Method is to pay off your debts in order of smallest balance to largest, regardless of interest rate. Here’s how you make it happen:

- List all your debts: From smallest balance to largest.

- Pay minimums on everything except the smallest debt: For all debts other than the smallest one, you just pay the minimum required amount.

- Attack the smallest debt: Throw every extra dollar you can find at that smallest debt. Get a bonus at work? Extra payment. Cut down on daily lattes? Extra payment. Hustle like crazy to send more money to that smallest balance! 💸

- Roll the payment: Once that smallest debt is GONE (HURRAY! 🎊), take the money you were paying on it (its minimum payment plus all the extra money you were throwing at it) and add it to the minimum payment of your *next smallest* debt.

- Repeat and Conquer: Keep rolling the payments into the next debt in line until every single one is paid off.

The beauty of the Debt Snowball isn’t primarily mathematical; it’s psychological. Those quick wins you get from paying off smaller debts rapidly create incredible momentum and motivation. Think of it like a video game: you get to slay a few smaller, weaker “debt monsters” first, building your confidence and financial strength before taking on the big bosses. This continuous feeling of achievement keeps you energized and committed, even when the journey feels long. It proves that you can do this, and those small victories can be incredibly powerful drivers for success.

Debt Snowball Spreadsheet Excel

Debt Snowball Spreadsheet Excel ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Debt Payoff Strategies: Avalanche & General Repayment 🌋

While the Snowball method is fantastic for motivation, there’s another powerful strategy, the Debt Avalanche Method, which is all about maximizing your money. If the Snowball is about quick emotional wins, the Avalanche is about cold, hard financial efficiency. And beyond these two titans, let’s touch upon general repayment principles that can apply to any strategy.

Unleashing the Avalanche 🏔️

The Debt Avalanche Method involves paying off your debts in order of highest interest rate to lowest interest rate, regardless of balance size. This is the mathematically optimal strategy, as it minimizes the total amount of interest you pay over the life of your debts, saving you the most money in the long run.

Here’s how to trigger your debt avalanche:

- List all your debts: This time, order them from highest interest rate to lowest interest rate.

- Pay minimums on everything except the highest-interest debt: Just like with the snowball, pay only the minimum required on all debts except the one with the highest interest rate.

- Attack the highest-interest debt: Direct every single extra dollar you can towards that debt. This is the debt that is costing you the most money every single day. Hammer it!

- Roll the payment: Once the highest-interest debt is gone, take all the money you were putting towards it and add it to the minimum payment of your next highest-interest debt.

- Repeat and Reap the Savings: Continue this process until all your debts are crushed, reveling in the knowledge that you’ve saved yourself potentially thousands of dollars in interest! 🤑

The Avalanche method requires a bit more discipline and delayed gratification because your first “win” might take longer if your highest-interest debt also happens to be a large one. However, if your primary goal is to save the most money possible and get out of debt as efficiently as possible, the Debt Avalanche is your champion.

Debt Avalanche Tracker - KDP Template

Debt Avalanche Tracker – KDP Template ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

General Repayment Wisdom: Applying the Principles

Beyond these two popular strategies, a few universal truths apply to almost any general repayment approach:

- Budgeting is Non-Negotiable: You simply cannot pay off debt effectively if you don’t know where your money is going. A budget reveals exactly how much extra money you have to throw at your debts each month. It’s the foundation of all debt repayment! 🏗️

- Find Extra Cash: Look for opportunities to earn more (side hustles, overtime) or spend less (cut subscriptions, dine out less, shop smarter). Every dollar saved or earned is another dollar you can send to your debts.

- Avoid New Debt: While tackling existing debt, it’s paramount to avoid incurring new debt. This can feel like trying to empty a bathtub with the faucet still running! Pause non-essential credit card spending.

- Automate Payments: Set up automatic minimum payments to avoid late fees. Once you’re attacking a specific debt, manually make those additional payments so you feel the impact.

- Celebrate Milestones: Whether it’s paying off your first small debt or hitting a major percentage paid off, acknowledge your progress! This fuels your motivation for the long haul. 🥳

Ultimately, the best debt payoff strategy is the one you can stick with. For some, the psychological boost of the Snowball is priceless. For others, the raw financial efficiency of the Avalanche is more compelling. The critical part is picking a method, tracking your progress meticulously, and remaining fiercely determined! Consistency truly is your best friend on this journey.

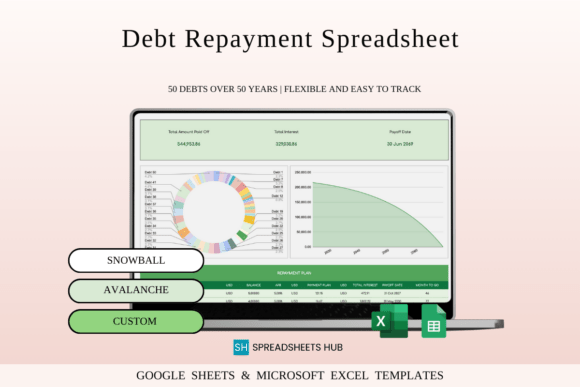

Debt Repayment Tracker

Debt Repayment Tracker ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Bringing It All Together: Your Path to a Debt-Free Life 🛤️

Wow, we’ve covered a lot of ground today, haven’t we? From the simplicity of a paper printout to the power of advanced digital platforms, and from the motivational snowball to the mathematically savvy avalanche, one thing is crystal clear: you have the power to take control of your debt! Debt isn’t a life sentence; it’s a challenge, and like any challenge, it can be overcome with the right tools, the right strategy, and a persistent, determined mindset.

Imagine the day you make that final payment. Imagine the sheer lightness you’ll feel, the newfound freedom to pursue your dreams without the heavy burden of interest payments. It’s not just about money; it’s about reclaiming your peace, your possibilities, and your power. And it all starts with one crucial step: understanding and tracking what you owe. Armed with an effective debt tracker, whether it’s your own beautifully crafted Excel sheet, a robust mobile app, or a vibrant bullet journal, you gain the clarity needed to make informed decisions. Couple that clarity with a smart payoff strategy, and you become an unstoppable force against financial stress.

The journey to debt freedom is a marathon, not a sprint, but every single step, every payment, every update to your debt tracker brings you closer to the finish line. Don’t wait another day to start your journey towards financial liberation. The tools are available, the strategies are laid out, and your financial freedom is waiting. 🚀

Ready to put these strategies into action and explore more ways to master your money? Dive deeper into our resources and discover personalized insights tailored just for you!

Visit Our Website & Start Your Journey Today!