Ever stared blankly at your bank statement, scratching your head, wondering where on earth all your hard-earned money disappeared to this month? 💸 You’re definitely not alone. For many, the journey into financial well-being feels less like a smooth drive and more like navigating a dense fog without a map. But what if I told you that the key to dispelling that fog, to truly understanding and taking control of your financial destiny, lies in one deceptively simple, yet incredibly powerful, practice: diligently tracking your income and expenses?

Think of your finances like a ship at sea. Without knowing how much fuel you have (income) and how much you’re burning through (expenses) on a daily, weekly, or monthly basis, how can you possibly set a course for your dream destination, whether that’s buying a house, saving for retirement, or simply enjoying more freedom? Without this knowledge, you’re merely drifting, subject to the whims of the financial tides. This article isn’t just about spreadsheets and numbers; it’s about empowerment. It’s about giving you the tools, insights, and motivation to become the captain of your financial ship, charting a clear path to wherever you want to go. We’ll delve deep, moving from the foundational concepts to practical tools, advanced strategies, and even a peek into some downloadable aids. Ready to take control? Let’s dive in! 🚀

Google Sheets Expense Tracker

Google Sheets Expense Tracker ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

The Cornerstone: Income and Expense: Basic Definitions

Before we build an empire of financial control, we need to lay a solid foundation. Let’s start with the absolute basics. What exactly are income and expenses in the grand scheme of your personal finances?

Income, simply put, is money flowing into your pockets. It’s the lifeblood of your financial existence. For most of us, this primarily comes from our jobs—our salary, wages, commissions, or business profits. But income isn’t always that straightforward. It can also include things like:

- Side Hustle Earnings: Are you moonlighting as a freelancer, a rideshare driver, or selling crafts online? That’s income!

- Investment Returns: Dividends from stocks, interest from savings accounts, rental income from properties.

- Gifts or Windfalls: While not regular, these still count as money coming in.

- Benefit Payments: Social security, unemployment, or disability payments.

Understanding the full spectrum of your income sources is crucial. It’s not just about what hits your bank account every two weeks; it’s about a holistic view of every single dollar that enters your financial sphere.

Now, for the flip side: Expenses. These are all the instances where money flows out of your pockets. Expenses are, quite frankly, everywhere! They represent everything you spend money on, from the obvious to the obscure. Categorizing them is key to understanding where your money is actually going. Generally, we can break them down into a few types:

- Fixed Expenses: These are typically the same amount each month and are relatively predictable. Think rent/mortgage, loan payments (car, student), insurance premiums, subscriptions (Netflix, gym membership). They are “fixed” because they don’t usually change much from month to month, offering a stable baseline for your outgoings.

- Variable Expenses: Ah, the tricky ones! These fluctuate based on your usage or choices. Groceries, utilities (electricity, water, gas, which can vary with season), transportation (gas for your car, public transport fares), entertainment, dining out. Managing these requires more attention, as they are often where budget leaks occur. A sudden surge in your electricity bill during a hot summer, or an unexpected string of social dinners, can significantly impact this category.

- Discretionary Expenses: These are “wants” rather than “needs.” Dining out, new clothes, vacations, hobbies, morning lattes, impulse purchases. These are often the first place to look when you’re trying to cut back and find more money for savings or debt repayment. Recognizing these versus necessities is a huge step in taking financial control.

By clearly defining both income and expenses, you start to see your money not as a mystical, disappearing act, but as a flowing river, with currents and tributaries you can direct and manage. 🏞️

Airbnb Income and Expense Spreadsheet

Airbnb Income and Expense Spreadsheet ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Beyond the Definitions: Why Tracking Matters & What Happens If You Don’t

So, you know what income is and what expenses are. Great! But why go through the “hassle” of actually tracking them? Isn’t it enough to just… not run out of money? Well, if that’s your goal, then perhaps. But if your goal is financial thriving, not just surviving, then tracking isn’t optional; it’s foundational.

Imagine trying to lose weight without ever weighing yourself or looking at your caloric intake. You might make some healthy choices, but without a baseline and ongoing measurement, you’ll be constantly guessing, prone to demotivation, and less likely to hit your goals. Your finances are no different. Tracking gives you:

- 📊 Crystal Clear Awareness: Where *exactly* is your money going? You might be surprised to find how much you spend on seemingly small things like daily coffee or subscription services you no longer use.

- 🎯 Goal Setting & Achievement: Want to save for a down payment? Pay off debt? Travel the world? Knowing your financial flow allows you to create realistic budgets and allocate funds towards these aspirations, turning dreams into actionable plans.

- 🤯 Reduced Financial Stress: A significant source of stress comes from uncertainty. When you know where you stand financially, you make informed decisions, reducing anxiety and improving overall well-being. No more “month-end panic”! 🙏

- 🛡️ Emergency Preparedness: By understanding your monthly expenses, you can build a more accurate emergency fund. Knowing exactly how much you need to cover 3-6 months of living costs provides an invaluable safety net.

- 💰 Identification of Saving Opportunities: Once you see your spending patterns, you can identify areas where you can cut back without feeling deprived, redirecting that money towards savings or investments.

What happens if you *don’t* track? Well, you likely remain in that financial fog. You might feel perpetually behind, unsure why you never have extra money despite earning a decent salary. Impulse purchases might derail your progress. Debt could quietly accumulate. You’re operating blind, relying on guesswork rather than data. And in the world of personal finance, guesswork often leads to regret. Don’t let your financial future be determined by inertia; choose insight!

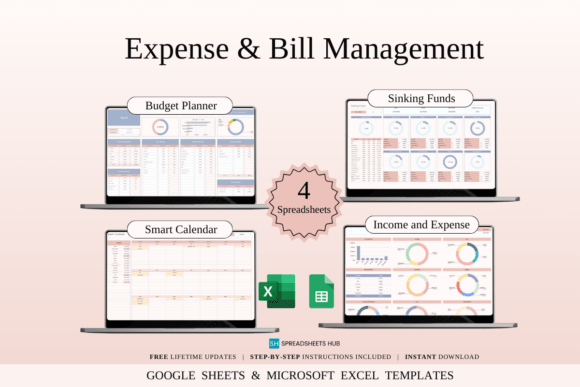

Expense & Bill Management Bundle | Excel

Expense & Bill Management Bundle | Excel ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Getting Started: Income and Expenses: Worksheets & Tables

Okay, you’re convinced. You need to start tracking. But where do you begin? For many, the idea of complex software or intricate spreadsheets can feel overwhelming. Don’t worry! You don’t need to be a tech wizard or an accounting genius. Sometimes, the simplest methods are the most effective for getting started and building that crucial habit. Enter: worksheets and tables.

Think of a simple table, whether drawn on a piece of paper or created in a basic word processor. Its strength lies in its simplicity and accessibility. Here’s how you can leverage Income and Expenses: Worksheets & Tables for effective tracking:

The Humble Hand-Drawn Table:

Grab a notebook, a ruler, and a pen. Create columns: Date, Description, Category (e.g., Groceries, Rent, Transport), Income (+), Expense (-), and maybe a running Balance. Every time money comes in or goes out, jot it down immediately. This tactile process helps solidify the habit. It’s wonderfully low-tech, private, and always available.

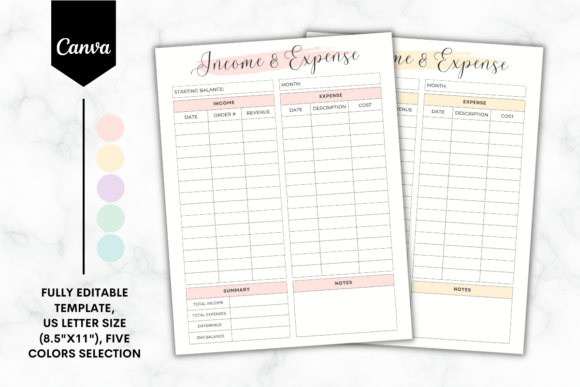

Income & Expense Tracker Template

Income & Expense Tracker Template ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Printable Grids:

Many websites (including potentially ours! 😉) offer simple printable income and expense templates. These provide pre-defined columns and rows, making it easy to just fill in the blanks. They remove the initial barrier of setting up the structure yourself. Perfect for visual learners or those who love the feel of pen on paper.

Digital Tables (Basic):

If pen and paper aren’t your jam, a simple table in a word document or a plain text file can work too. The principle is the same: columns for data, rows for entries. It’s more searchable than a physical notebook, but still keeps things uncomplicated compared to a full spreadsheet application.

The beauty of worksheets and tables is their low barrier to entry. You don’t need special software, an internet connection, or an accounting degree. They are fantastic for:

- Building the initial habit of recording every transaction. ✍️

- Visualizing your daily or weekly spending patterns quickly.

- Individuals who prefer a less digital, more hands-on approach.

The main limitation? Scaling. For long-term analysis, complex calculations, or detailed categorization across months and years, they can become cumbersome. But for dipping your toes into the world of financial tracking, they are an excellent, judgment-free starting point.

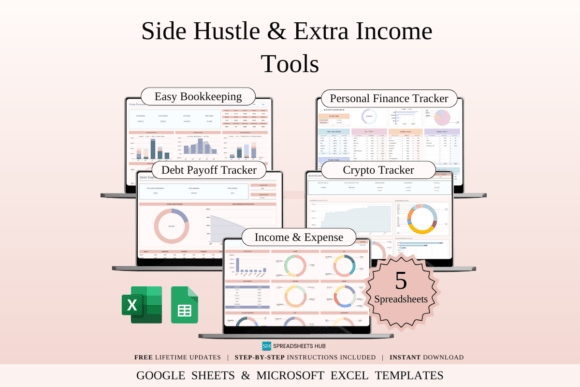

Side Hustle & Extra Income Tools | Excel

Side Hustle & Extra Income Tools | Excel ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

The Detailed Story: Income and Expense: Journals & Logs

Beyond the rigid structure of a table, an income and expense journal or log offers a more descriptive, narrative approach to tracking. Think of it less as an accountant’s ledger and more as a personal diary for your money. This method might particularly appeal to those who enjoy writing or who want to add more qualitative context to their financial entries.

Income and Expense: Journals & Logs typically involve recording not just the “what” and “how much,” but also the “why” and “how you felt” about a transaction. A journal entry might look like this:

Date: October 26th

Type: Expense (Shopping)

Amount: $125

Description: New pair of sneakers. Decided to treat myself after hitting my project deadline. Maybe I should have waited, but they were on sale and I’ve been eyeing them. Note to self: Check if this fits into my discretionary spending budget. Feeling a mix of excitement for new shoes and mild guilt.

While less immediately conducive to numerical analysis than a spreadsheet, the insights gained from such detailed logging can be invaluable for understanding your spending psychology. This method helps you:

- Gain a deeper emotional connection to your money. 🤔

- Identify patterns of emotional spending (e.g., stress shopping, boredom spending).

- Reflect on your financial decisions in a non-judgmental space.

- Document irregular income sources or one-off expenses with greater detail.

It’s an intimate way to track, perfect for personal reflection and behavioral change. While you’ll still want to periodically summarize your totals (perhaps by transferring them to a basic worksheet or spreadsheet), the journal provides the rich context behind the numbers. It’s the storytelling version of your financial life, offering a unique path to self-awareness and improved financial habits.

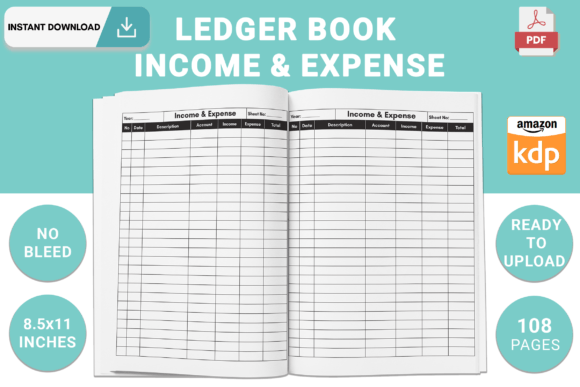

Ledger Book:Income & Expense Logbook KDP | Excel

Ledger Book:Income & Expense Logbook KDP | Excel ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Powering Up: Income and Expense Spreadsheets

Ready to elevate your tracking game? If worksheets are your trusty bicycle, then Income and Expense Spreadsheets are your sleek, high-performance car. Spreadsheets offer unparalleled flexibility, power, and scalability for managing your financial data. They transform simple recording into insightful analysis, allowing you to slice and dice your information in ways that plain tables or journals simply can’t.

At their core, spreadsheets are digital grids made up of cells arranged in rows and columns. What makes them so powerful is the ability to use formulas. Formulas allow you to automate calculations, summarize data, and perform complex analyses with minimal effort once set up. This means no more manually adding up columns of numbers or recalculating balances!

The Core of Any Good Income and Expense Spreadsheet:

A well-designed income and expense spreadsheet typically includes several key elements:

- Date: The day the transaction occurred.

- Description: A brief note about what the transaction was for (e.g., “Grocery run,” “Netflix subscription,” “Paycheck”).

- Category: This is critical for analysis! Think “Housing,” “Utilities,” “Groceries,” “Transport,” “Entertainment,” “Income – Salary,” “Income – Side Hustle.” Categories allow you to group similar transactions and see spending patterns.

- Amount: The monetary value of the transaction. Often split into “Income” and “Expense” columns for clarity, or simply a single “Amount” column with positive (income) and negative (expense) values.

- Payment Method (Optional but useful): How the transaction was paid (e.g., Credit Card, Debit Card, Cash, Bank Transfer). This can help with reconciliation.

- Running Balance (Optional but highly recommended): A formula that constantly updates your available cash, helping you see where you stand after each transaction.

The beauty? You create this structure yourself. You dictate the categories, the level of detail, and the types of reports you want to generate. It’s highly customizable to your unique financial situation and needs. While it might take a little upfront time to set up, the long-term benefits are immense. It’s like building your own financial command center. 🏰

Income and Expense Tracker Spreadsheet

Income and Expense Tracker Spreadsheet ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

The Digital Maestros: Income and Expenses: Excel & Google Sheets

When we talk about spreadsheets, we’re almost certainly talking about either Microsoft Excel or Google Sheets. These two giants are the go-to platforms for managing your Income and Expenses: Excel & Google Sheets. They offer similar functionalities but cater to slightly different preferences.

Microsoft Excel: The Professional Powerhouse

Excel is the industry standard for spreadsheet software. It’s robust, incredibly powerful, and capable of handling vast amounts of data with complex calculations. If you already have Microsoft Office, you have Excel, making it readily accessible. Key features for financial tracking:

- ⚡️ Advanced Formulas: From SUM to AVERAGE to SUMIF and VLOOKUP, Excel’s formula library is extensive, allowing you to create highly dynamic and automated financial reports.

- 📈 Data Visualization: Create stunning charts and graphs (bar, pie, line charts) from your income and expense data to easily visualize trends, spending categories, and progress towards goals.

- 🏷️ PivotTables: For truly advanced analysis, PivotTables allow you to summarize, reorganize, and analyze large datasets, revealing hidden patterns in your spending over time.

- 🗄️ Data Validation: You can set rules to ensure data is entered correctly, preventing errors in your tracking.

The main considerations for Excel are that it typically requires a paid subscription (though many companies or schools provide it) and is primarily desktop-based, though mobile apps exist.

Google Sheets: The Collaborative, Cloud-Based Champion

Google Sheets, part of Google Workspace, is a free, web-based spreadsheet program. Its biggest strength is its cloud-native design, making it inherently collaborative and accessible from any device with an internet connection. Key benefits for managing your finances:

- 🌐 Free & Accessible: All you need is a Google account. Access your budget from your computer, phone, or tablet anywhere.

- 🤝 Real-time Collaboration: If you manage finances with a partner or family member, Sheets allows you to work on the same document simultaneously, seeing changes in real time. Perfect for couples!

- 🔄 Version History: Never lose data! Sheets automatically saves changes and allows you to revert to previous versions, a lifesaver if you accidentally delete something important.

- 🚀 Strong Formula Support: While not as exhaustive as Excel for niche functions, Google Sheets has more than enough powerful formulas for most personal finance tracking needs.

Both Excel and Google Sheets offer robust template galleries, which means you don’t have to start from scratch! You can find a template for a budget, income tracker, or expense log, adapt it to your needs, and save yourself hours of setup. Whichever you choose, committing to one of these platforms is a significant step towards truly mastering your money. They turn mere data entry into powerful financial insight. 💡

Income and Expense Tracker, Google Sheet | Excel

Income and Expense Tracker, Google Sheet | Excel ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Strategy & Structure: Income and Expense: Planning & Templates

Tracking is great, but using that data for planning is where the magic truly happens. Your income and expense figures aren’t just historical records; they’re the raw ingredients for crafting your financial future. This is where Income and Expense: Planning & Templates become invaluable. They transform reactive tracking into proactive financial management.

The Budget as Your Blueprint:

A budget is essentially a spending plan. It takes your anticipated income and strategically allocates it to various expense categories and savings goals before the month even begins. Your historical income and expense data provides the foundation for this. If you know you typically spend $400 on groceries, that’s what you budget for. If you discover you’ve been overspending on dining out, you can set a lower budget for it and plan to cook more at home.

Planning isn’t just about limiting spending; it’s also about optimizing it. Perhaps your tracking reveals you have money available for investments, or you can significantly increase your debt payments. A clear plan gives every dollar a job, ensuring it aligns with your larger financial objectives.

The Power of Templates:

Starting a budget or financial plan from scratch can feel daunting. This is where templates shine! A budget template in Excel or Google Sheets provides a pre-built framework, including common income and expense categories, sum formulas, and often sections for tracking goals. Many templates are designed to visually show your budget versus your actual spending, highlighting areas where you’re on track or need to adjust.

- 💰 Budgeting Templates: Often include sections for estimated income, actual income, fixed expenses, variable expenses, savings goals, and a ‘money left’ or ‘net cash flow’ section. They can also break down expenses by percentages.

- 🎯 Debt Repayment Templates: If paying off debt is a priority, templates can help you calculate how much you need to pay monthly to hit a target repayment date, accounting for interest.

- 🌱 Savings Goal Templates: Want to save $5,000 for a vacation? A template can show you how much you need to save each month or week to reach that goal by a specific date.

- 📊 Cash Flow Forecast Templates: More advanced templates allow you to project your income and expenses into the future, helping you anticipate lean months or identify periods when you’ll have extra cash.

Think of templates as training wheels for your financial planning bicycle. They provide structure, simplify the calculations, and allow you to focus on the numbers and your financial choices rather than the spreadsheet mechanics. Once you become comfortable, you can customize them endlessly or even build your own from the ground up! The key takeaway here is to not just track, but to act on the data through thoughtful planning.

Debt Snowball Spreadsheet Excel

Debt Snowball Spreadsheet Excel ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Precision in Time: Time-Oriented Income and Expense Tracking

Understanding your money flows isn’t a static exercise; it’s dynamic, changing with time. This is where Time-Oriented Income and Expense Tracking becomes incredibly insightful. How you track over different periods—daily, weekly, monthly, quarterly, yearly—can reveal vastly different patterns and provide unique insights into your financial behavior.

Daily Tracking: The Micro View

For beginners, daily tracking is excellent. It ensures no transaction slips through the cracks. Immediately after buying that coffee or paying a bill, you log it. This builds an immediate habit and fosters mindfulness about every dollar spent. It’s the ultimate “spot check” for financial leaks. However, analyzing daily data can be overwhelming without aggregation.

Weekly Tracking: Short-Term Snapshots

Often suitable for those with frequent transactions or irregular income. You review your spending at the end of each week, categorizing and tallying. This gives you quick feedback and allows for mid-month adjustments. Are you overspending on lunches this week? You can course-correct before the month is over. It provides a helpful feedback loop.

Monthly Tracking: The Standard Approach

This is the most common and often most effective rhythm for personal finance. Most bills, paychecks, and budgeting cycles are monthly. By the end of each month, you compare your actual income and expenses against your budget. This allows you to identify trends over a relevant period and make strategic adjustments for the following month. For example, if your utility bill spiked this month, you can adjust next month’s energy consumption. This is where most robust spreadsheets come in handy, allowing easy monthly summaries.

Monthly Budget Spreadsheet Excel

Monthly Budget Spreadsheet Excel ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Quarterly Tracking: Identifying Irregularities

Looking at your finances every three months can help spot expenses that aren’t monthly, like quarterly insurance premiums, semi-annual car maintenance, or less frequent large purchases. It helps you prepare for these less frequent, yet significant, outflows that might be missed on a monthly view. It also smooths out month-to-month fluctuations that might occur due to varying weekly spending or bill payment dates.

Annual Tracking: The Big Picture

Analyzing your income and expenses annually provides the broadest view. It helps you assess your overall financial health and progress towards long-term goals. Did your income grow this year? Did your overall spending increase or decrease? How much did you truly save for retirement or a down payment in the last 12 months? This perspective is crucial for tax planning, identifying yearly patterns (e.g., higher spending around holidays), and celebrating major milestones like becoming debt-free. 🥳

By utilizing different time frames, you gain a layered understanding of your money. Daily habits build into weekly patterns, which shape monthly flows, ultimately defining your yearly financial progress. It’s like using different lenses on a camera to see both the fine details and the sweeping landscape of your financial journey. Each perspective offers unique value. 📸

Annual Budget Spreadsheet Template Excel

Annual Budget Spreadsheet Template Excel ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Tangible Tools: Income and Expense Tracker Printable

In our increasingly digital world, sometimes the simple act of putting pen to paper can be incredibly powerful, especially when it comes to forming new habits. This is where an Income and Expense Tracker Printable comes into its own. While digital spreadsheets offer immense analytical power, a physical printable provides a tangible, often less intimidating, entry point into the world of financial tracking.

Why Choose a Printable?

- 🖋️ Simplicity & Low Barrier to Entry: No software to learn, no internet connection required. Just print, grab a pen, and start!

- 🧘♀️ Mindfulness & Reduced Screen Time: The act of manually writing can force you to slow down, be more deliberate, and truly engage with each transaction. It can also be a welcome break from screens.

- 📈 Visual Reinforcement: Having a physical tracker visible – on your fridge, desk, or in a dedicated binder – serves as a constant reminder and encourages consistency. There’s a satisfaction in filling in each line!

- ⚙️ Customization (with scissors and glue!): While not as dynamic as a spreadsheet, you can still print multiple copies, create dedicated sections in a binder, or even combine different printables to create a system that works for you.

- 🧑🏫 Ideal for Beginners: If you’re new to tracking, a printable can be less intimidating than diving straight into Excel. It helps you establish the core habit before adding layers of digital complexity.

What to Look for in a Good Printable Tracker:

- Clear Layout: Easy-to-read columns and rows for Date, Description, Category, Income, and Expense.

- Sufficient Space: Enough room to write clear descriptions for your transactions.

- Category Options: Some printables offer pre-filled common categories, while others provide blank spaces for you to customize your own.

- Summary Sections: The best printables include a section at the bottom or on a separate page to total your income, expenses, and calculate your net flow for the period (week/month).

- Aesthetic Appeal: While functional, a well-designed printable can make the tracking process more enjoyable.

Many websites (including possibly our own!) offer a variety of free or low-cost Income and Expense Tracker Printable templates that you can download and use immediately. It’s a fantastic, low-tech way to gain tangible control over your money, one handwritten entry at a time. It may just be the perfect stepping stone before you move on to more advanced digital tools, or a perfect complement if you simply prefer a tangible record. Remember, the best tracking method is the one you actually use consistently! 👍

Free Printable Income Tracker

Free Printable Income Tracker ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Overcoming Challenges and Cultivating a Lasting Habit

Let’s be real: starting something new is often easier than sticking with it. Tracking income and expenses, while immensely beneficial, isn’t immune to the forces of procrastination and inertia. You might start with enthusiasm, only to find your log empty a few weeks later. So, how do you overcome common challenges and cultivate a lasting habit?

Common Pitfalls & How to Avoid Them:

- 😫 Feeling Overwhelmed: Don’t try to go from zero to financial wizard overnight. Start simple. Maybe just track income for a week. Then add expenses for fixed categories. Gradually add complexity. A journey of a thousand miles begins with a single step. 🚶♀️

- 🤦♀️ Inconsistency: The biggest killer of any good habit. Link your tracking to an existing routine. Log transactions when you review your receipts, while waiting for your morning coffee, or before bed. Make it a non-negotiable daily or weekly check-in. Consistency beats intensity!

- ⚖️ Judgment & Guilt: When you first see where your money goes, there might be moments of “Oh no!” Don’t judge past decisions. Use the data as information, not as a weapon against yourself. It’s about awareness, not shame.

- 🙄 Boredom: Let’s face it, tracking isn’t always thrilling. Try to make it a little fun. Gamify it! Challenge yourself to stay under budget in a category. Reward yourself for sticking to it for a month or quarter. Or find an aesthetically pleasing spreadsheet or printable that you enjoy using.

- 🤷♀️ Lack of Purpose: If you’re tracking without a clear goal (saving for something, paying off debt), it’s easy to lose motivation. Connect your tracking to your bigger dreams. Remind yourself *why* you’re doing this – for financial peace, for that vacation, for freedom! 🗽

All-in-One Simple Spreadsheet Bundle

All-in-One Simple Spreadsheet Bundle ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Tips for Sticking With It:

- 📅 Schedule It: Put a recurring entry in your calendar: “30 min: Financial Check-in.” Treat it like any other important appointment.

- 🤖 Automate Where Possible: Use banking apps to categorize transactions automatically where feasible. Link your accounts to budgeting software if that fits your preference (though this article focuses more on manual tools for direct control, it’s worth considering for automation assistance).

- 🌟 Celebrate Small Wins: Did you stick to your budget for the first time? Did you successfully log every transaction for a week? Acknowledge your efforts and celebrate these mini-victories. Positive reinforcement is powerful.

- 🗣️ Find an Accountability Partner: If comfortable, share your goals with a trusted friend or family member. Check in with each other regularly.

- 🧘 Practice Mindfulness: Before any purchase, pause for a moment. Ask yourself: “Does this align with my budget? Is this a need or a want? Do I truly want this more than my financial goal?” This pause can significantly impact impulsive spending.

Remember, developing a financial tracking habit isn’t a sprint; it’s a marathon. There will be days you forget or feel discouraged. The key is to simply get back on track. Each effort, no matter how small, moves you closer to financial mastery. You have the power within you to transform your relationship with money, one entry at a time. 💪

Time-Saving Spreadsheet Bundle

Time-Saving Spreadsheet Bundle ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Conclusion: Your Journey to Financial Empowerment Begins Now

We’ve journeyed through the intricate landscape of income and expense tracking, starting from the basic definitions and exploring various tools and strategies along the way. We’ve seen how understanding what comes in and what goes out is the bedrock of all sound financial decision-making. From simple worksheets and tables to detailed journals and logs, from powerful Income and Expense Spreadsheets built in Excel & Google Sheets to the structured clarity of planning and templates, and the granular insights from time-oriented tracking to the reassuring simplicity of a printable tracker – the options are diverse, tailored for every preference and starting point.

The truth is, true financial freedom isn’t just about earning more money; it’s profoundly about knowing your money. It’s about turning confusion into clarity, guesswork into informed decisions, and stress into confidence. By consistently engaging with the principles and tools discussed, you transform your relationship with your finances from one of passive reaction to one of active control and intentional planning.

Imagine a future where you never have to wonder where your money went, where every dollar has a purpose, and where your financial goals are not just dreams, but tangible milestones on a well-charted map. That future is within your reach, and the journey begins with the powerful, simple act of tracking. Don’t wait for your finances to magically organize themselves. Take that first step today, or solidify your existing efforts with newfound knowledge. Your financial freedom awaits. 🏆

Ready to put these strategies into practice and explore more resources that can guide your financial journey? Visit our website today! We have a wealth of tools, articles, and potentially even downloadable templates to help you unlock your financial potential. Your empowered financial future starts here! ✨