Let’s be real for a second. Have you ever looked at your bank account a few days before your next paycheck and wondered where all the money went? It’s a sinking feeling, isn’t it? One moment, your account is flush with a fresh deposit, full of promise and possibility. The next, it’s a barren wasteland, and you’re surviving on instant noodles and pure hope. You work hard for your money, so why does it feel like it has a mind of its own, slipping through your fingers like sand? 😥

What if I told you there’s a way to stop this cycle? A way to become the master of your money, not its victim? A method so simple, yet so powerful, that it can completely transform your financial life. It’s not some get-rich-quick scheme or complicated financial wizardry. It’s called paycheck budgeting, and it’s about to become your new best friend.

Forget everything you think you know about budgeting. We’re not talking about restrictive, soul-crushing spreadsheets that make you feel guilty for buying a latte. We’re talking about a dynamic, empowering system that gives every single one of your hard-earned dollars a specific job. Think of it as creating a personalized GPS for your money. Instead of just having a final destination (like “saving money”), you’re setting clear, turn-by-turn directions for your money to follow from the moment it hits your account. 🗺️

In this ultimate guide, we are going to dive deep into the world of paycheck budgeting. We’ll explore everything from finding the right rhythm for your pay cycle to the best tools for the job—whether you’re an old-school pen-and-paper lover or a digital-savvy techie. We’ll look at free printable templates, powerful Excel and Google Sheets, slick digital planners, and specific methods with real-world examples. By the end of this, you’ll be armed with the knowledge and tools to take back control and finally tell your money exactly where to go. Ready to stop wondering and start winning? Let’s get into it!

Ultimate Paycheck Budget Spreadsheet

Ultimate Paycheck Budget Spreadsheet ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

What is Paycheck Budgeting, Really? (And Why It’s a Game-Changer)

So, what’s the magic behind this “paycheck budget” method? It’s beautifully simple: instead of creating one massive, overwhelming budget for the entire month, you create a new, small budget every single time you get paid. That’s it! If you get paid bi-weekly, you’ll make a new budget every two weeks. If you’re paid weekly, you’ll do it every week.

Why is this so incredibly effective? It comes down to psychology. A monthly budget can feel like trying to plan a massive, month-long road trip on a single, giant map. It’s easy to get lost, take wrong turns early on, and run out of gas (money) before you reach your destination. But a paycheck budget is like planning a series of short, manageable drives. You only have to focus on the next stretch of road—the time between now and your next paycheck. It’s less intimidating, far more accurate, and it gives you a fresh start with every payday. It’s proactive, not reactive. ✨

This method breaks down your financial life into bite-sized, manageable chunks. You’re no longer guessing how much you can spend on groceries for the entire month. You’re planning exactly how much you need for the next two weeks. This incredible focus helps you to see where your money is actually going and make immediate adjustments. It’s the difference between seeing a blurry, out-of-focus picture of your finances and having a crystal-clear, high-definition view. This clarity is what gives you a profound sense of control and significantly reduces financial anxiety. You’re no longer just hoping you have enough; you know you do because you’ve planned for it.

Budget by Paycheck Spreadsheet

Budget by Paycheck Spreadsheet ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Finding Your Rhythm: Weekly, Bi-Weekly, or Monthly Paycheck Budgets? 🗓️

Not all paychecks are created equal, and your budgeting rhythm should reflect that. The beauty of this method is its flexibility. You can adapt it perfectly to your unique income flow. So, which schedule is right for you? Let’s break it down.

The Weekly Warrior: For Maximum Control

A weekly paycheck budget is perfect for anyone with an irregular or fluctuating income. Are you a freelancer, a gig worker, or do you work in an industry with variable hours and tips (like a server or barista)? Then this is for you!

- Pros: You have an incredibly tight rein on your finances. You can adjust your spending plan on the fly as your income changes from week to week. It’s nearly impossible to overspend because your next “reset” is only a few days away.

- Cons: It can feel a bit high-maintenance. Budgeting every single week requires discipline, and if you fall off for one week, it can be easy to lose track. It’s a constant commitment.

Weekly Paycheck Printable Planner

Weekly Paycheck Printable Planner ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

The Bi-Weekly Standard: The Sweet Spot for Many

This is the most common pay schedule for a reason, and it’s a fantastic rhythm for budgeting. The bi-weekly paycheck budget is the gold standard for millions of people. It provides a great balance between control and convenience.

- Pros: It aligns perfectly with a common pay cycle, making it intuitive to manage bills. It’s less tedious than weekly budgeting but still gives you a frequent fresh start. The real magic? You get two or three “three-paycheck months” a year. These are incredible opportunities to make a huge dent in debt or supercharge your savings with that “extra” paycheck. 🚀

- Cons: The main challenge is managing those fixed monthly bills, like rent or a mortgage. Since some pay periods will have rent due and others won’t, you have to plan ahead. A common strategy is to split the cost of big bills—like rent—in half, putting aside 50% from each paycheck to cover it.

Biweekly Paycheck Budget Tracker Finance

Biweekly Paycheck Budget Tracker Finance ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

The Monthly Maverick: Simple and Streamlined

A monthly paycheck budget works best for those with a very consistent, predictable salaried income and stable expenses. If you get paid once a month, this is your go-to. However, some people who are paid bi-weekly but have very simple finances might still prefer this method.

- Pros: It’s the “set it and forget it” of budgeting (well, almost). You only have to do the heavy lifting once a month, which is great if you prefer a more hands-off approach. It’s simple and clean.

- Cons: The biggest risk is the temptation to overspend early in the month. With a whole month’s worth of money in your account, it’s easy to feel rich for the first week and be broke by the third. It requires significant self-discipline and foresight. This is the least “paycheck budget” of the bunch, but for some, it’s all that’s needed.

Ultimate Monthly Budget Spreadsheet

Ultimate Monthly Budget Spreadsheet ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Your Financial Toolkit: Choosing Your Budgeting Weapon 🛠️

Okay, you’ve found your rhythm. Now, it’s time to choose your tool. There’s no single “best” way to do this; the best tool is the one you’ll actually use consistently. Whether you’re a tactile person who loves the feel of pen on paper or someone who lives in the cloud, there’s a perfect option waiting for you.

1. The Old-School Classic: Free Printable Paycheck Budgeting 📝

There’s something incredibly satisfying and powerful about physically writing things down. It connects your brain to your actions in a way that typing sometimes can’t. This is where free printable paycheck budgeting shines. You can find thousands of beautifully designed and incredibly practical templates online (many for free!).

A good printable will have sections for:

- Income: Where you list your paycheck amount.

- Fixed Expenses: Bills that are the same every time (rent, car payment, subscriptions). You’ll only list the ones due during this pay period.

- Variable Expenses: The flexible stuff (groceries, gas, entertainment). You’ll set a budget for these for the coming weeks.

- Savings & Debt: Earmarking money for your goals, whether it’s building an emergency fund or slaying that credit card debt.

Putting pen to paper forces you to slow down and be mindful. Pin it to your fridge or keep it in a binder. The visual reminder is a constant, gentle nudge to stay on track. Plus, the feeling of crossing off a paid bill or hitting a savings goal is just chef’s kiss perfect.

Paycheck Budgeting Worksheet

Paycheck Budgeting Worksheet ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

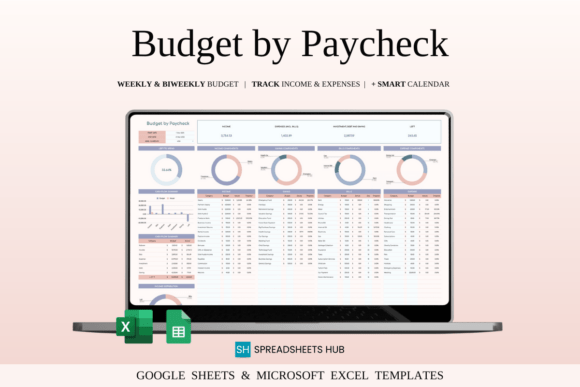

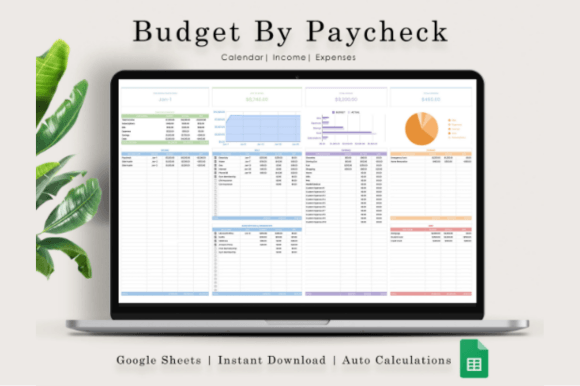

2. The Spreadsheet Sorcerers: Excel & Google Sheets Templates 💻

If you love data, formulas, and seeing your finances come to life in colorful charts, then a spreadsheet is your holy grail. This is where you can truly customize every single aspect of your budget.

A Paycheck Budget: Excel Spreadsheets & Templates setup is for the person who wants ultimate power. Excel is a beast. You can create formulas that automatically calculate your remaining balance, build sophisticated charts to track your spending trends over time, and create summary dashboards that give you a bird’s-eye view of your entire financial world. The only limit is your imagination (and maybe your VLOOKUP skills).

Budget by Paycheck Spreadsheet in Excel

Budget by Paycheck Spreadsheet in Excel ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

On the other hand, we have Paycheck Budget: Google Sheets Templates. This is Excel’s cooler, cloud-based cousin. The major advantage? Accessibility and collaboration. You can access and update your budget from your phone, tablet, or computer, wherever you are. Even better, if you share finances with a partner, you can both be in the sheet at the same time, making changes and staying on the same page in real-time. No more “Did you pay the electric bill?” texts. Just look at the sheet! There are tons of amazing, free Google Sheets templates that are pre-built with all the formulas you need to get started instantly.

Google Sheets Budget Template

Google Sheets Budget Template ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

3. The Modern Techie: Digital Planners & Budgeting Apps 📱

For those who live on their phone and love the convenience of modern technology, budgeting apps and digital planners are the answer. They automate much of the tedious work, making budgeting faster and, for many, easier.

Popular apps like YNAB (You Need A Budget), Mint, or EveryDollar are built specifically for methods like paycheck budgeting. They can securely sync to your bank accounts, automatically importing your transactions and categorizing them for you. They give you a real-time picture of your spending without you having to manually enter every single purchase. It’s like having a tiny financial assistant in your pocket.

Then there’s the new kid on the block: Paycheck Budget Digital Planners & More Apps. This is a fantastic hybrid option. It combines the aesthetic and manual satisfaction of a paper planner with the convenience of a digital device. These are typically PDF templates that you import into a note-taking app on a tablet, like Goodnotes or Notability. You can write on them with a stylus, add digital stickers, and customize them to your heart’s content, all while keeping everything neatly organized and paper-free.

Digital Budget Planner, Financial Planner

Digital Budget Planner,Financial Planner ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Don’t Underestimate a Pretty Layout: Paycheck Budget Aesthetic & Design ✨

This might sound fluffy, but stick with me. The Paycheck Budget Aesthetic, Design & Layout is more important than you think. Why? Because of human psychology. If your budget is a bland, intimidating wall of black-and-white numbers, it feels like a chore. You will procrastinate. You will avoid it. And eventually, you will abandon it.

But what if your budget was… beautiful? What if it was something you actually enjoyed looking at? 🎨

Whether it’s a printable planner with a gorgeous floral design, a Google Sheet with your favorite color-coding system, or a digital planner with fun stickers and washi tape, an aesthetically pleasing budget turns a tedious task into an inviting ritual. It becomes an act of self-care. When you create something that visually appeals to you, you’re more motivated to engage with it. You’ll want to open your planner and track your spending. You’ll look forward to sitting down with your colorful spreadsheet. So go ahead—embrace the aesthetic. Pick a design that makes you happy. Your consistency (and your bank account) will thank you.

Financial Planner, Canva Template

Financial Planner, Canva Template ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Let’s Get Practical: Specific Methods & A Walkthrough Example 👩🏫

Theory is great, but let’s put this into practice. There are several popular budgeting philosophies that work beautifully with the paycheck method. The most powerful of all is the Zero-Based Budget.

The King of Methods: Zero-Based Budgeting

This is the secret sauce. The concept is simple: Income – Expenses = Zero. That doesn’t mean you spend every penny until you have a zero balance in your account! It means that every single dollar from your paycheck is assigned a job. Some dollars will be assigned to rent, others to groceries, and others to savings or debt. Nothing is left to chance. You tell your money exactly where to go, down to the last cent.

A Step-by-Step Example: Alex’s Bi-Weekly Paycheck Budget

Let’s meet Alex. Alex gets paid $1,800 (after taxes) every two weeks. Rent is $1,200/month, and the car payment is $300/month. Let’s create a zero-based budget for Alex’s first paycheck of the month.

Step 1: List the Income for this Pay Period.

- Paycheck 1: +$1,800

Step 2: List Fixed Expenses DUE in this Pay Period.

Alex pays rent on the 1st. To make it manageable, Alex sets aside half the rent from each paycheck. The car payment is also due on the 5th, so it comes out of this first check.

- Rent (Half): -$600

- Car Payment: -$300

- Phone Bill: -$50

- Streaming Services: -$25

Total Fixed Expenses: -$975

Step 3: Budget for Variable Expenses (aka The Fun Stuff & Life).

This is where you plan for the next two weeks of spending. Alex looks at the calendar and allocates money accordingly.

- Groceries: -$250

- Gas/Transportation: -$100

- Personal Spending (Coffee, lunches out): -$75

- Entertainment (Movies, seeing friends): -$100

Total Variable Expenses: -$525

Step 4: Pay Yourself First! Allocate to Goals.

Now we see what’s left and assign it to our goals. This is the most important step!

Math Check: $1800 (Income) – $975 (Fixed) – $525 (Variable) = $300 remaining.

- Savings (Emergency Fund): -$200

- Extra Debt Payment (Credit Card): -$100

Total to Goals: -$300

Step 5: The Final Check. Does It Equal Zero?

Income ($1800) – Fixed Expenses ($975) – Variable Expenses ($525) – Goals ($300) = $0

Boom! 💥 Every single dollar from Alex’s $1,800 paycheck has a name and a purpose. There is no mystery. There is no “where did it go?” feeling. There is only clarity and control. Alex knows exactly what to spend for the next two weeks and has still made incredible progress on financial goals.

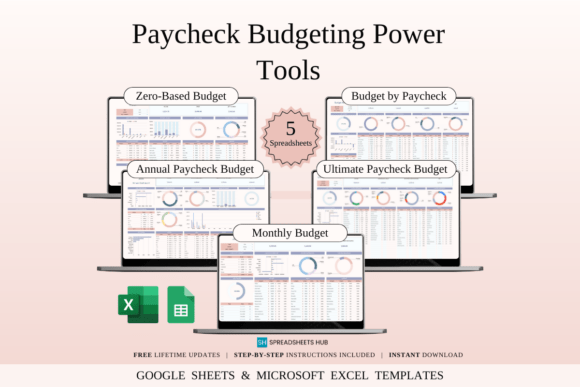

Paycheck Budgeting Power Tools in Excel

Paycheck Budgeting Power Tools in Excel ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Conclusion: Your Financial Future Starts Now

We’ve covered a lot of ground. From understanding the core power of budgeting with every paycheck to finding your perfect rhythm and tools. We’ve seen how a beautiful design can be a motivator and walked through a real-world example of putting every dollar to work.

The key takeaway is this: budgeting is not about restriction; it’s about freedom. It’s the freedom from financial anxiety, the freedom from the paycheck-to-paycheck cycle, and the freedom to build the life you truly want. You have the power to transform your financial reality, and it starts with the very next time you get paid.

Don’t let this be just another article you read and forget. Take the first step. Choose a tool—a printable, a spreadsheet, an app—and commit to creating a budget for your next paycheck. It might not be perfect the first time, and that’s okay. This is a skill, and like any skill, it gets better with practice. Be patient, be consistent, and watch as you become the confident, in-control master of your own money.

Ready to dive in and get your hands on the best resources? We’ve got you covered! Visit our website now to access our exclusive library of free printable paycheck budget templates, pre-built Excel and Google Sheets, and our top recommendations for digital planners and apps. Stop wishing for financial clarity and start creating it. Your journey to financial freedom is just one click away!