Hey there, savvy savers! 👋 Ever feel like your bills are playing hide-and-seek with your bank account? One moment you’re riding high, the next, bam! A surprise bill jumps out, throwing your budget into chaos. Sound familiar? You’re definitely not alone. In today’s fast-paced world, staying on top of our finances can feel like a never-ending juggling act. But fear not! This ultimate guide to bill trackers is here to turn you into a money-management ninja. 🥷

We’re going to explore every nook and cranny of the bill-tracking universe. There’s a bill tracker for everyone, from tech experts to spreadsheet lovers and even those who prefer using pen and paper. So, buckle up, grab your favorite beverage, and let’s dive in! 🚀

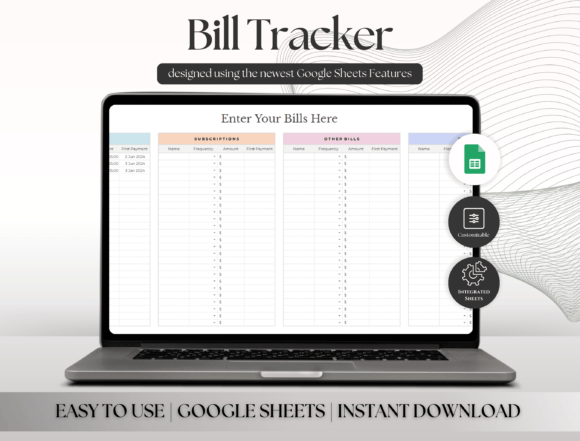

Bill Tracker Spreadsheet

Bill Tracker Spreadsheet ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Digital & App-Based Bill Trackers: Your Pocket-Sized Finance Manager 📱

In the age of smartphones, why not put your tech to good use? Digital and app-based bill trackers are like having a personal finance assistant right in your pocket. These tools offer a seamless, automated way to monitor your bills, set reminders, and even forecast your spending habits. Pretty cool, right?

Why Go Digital? 🤔

- Convenience is King: Access your bill information anytime, anywhere. No more rummaging through piles of paper! 📂

- Automation is Your Friend: Many apps automatically sync with your bank accounts, importing your bills and transactions in real-time. Talk about effortless! 😌

- Stay on Top of Deadlines: Set reminders and receive notifications so you never miss a payment again. Late fees? Say goodbye! 👋

- Visualize Your Spending: Most apps offer colorful charts and graphs that give you a bird’s-eye view of your finances. Knowledge is power! 🧠

Top App-Based Bill Trackers:

- Mint: A classic for a reason. Mint offers a comprehensive overview of your financial life, including bill tracking, budgeting, and investment monitoring [1].

- Personal Capital: Great for investors. In addition to bill tracking, Personal Capital provides tools for managing your investments and planning for retirement [1].

- YNAB (You Need A Budget): A more hands-on approach to budgeting and bill tracking. YNAB teaches you to be proactive about your spending and saving habits [1].

- PocketGuard: Simple and intuitive, PocketGuard helps you stay within your spending limits by showing you how much you have “in your pocket” after bills and savings goals [1].

Choosing the right app depends on your individual needs and preferences. Do some research, read reviews, and try out a few free trials to see what works best for you. Your perfect finance sidekick is out there waiting! 🤩

Bill Payment Calendar Template Excel

Bill Payment Calendar Template Excel ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

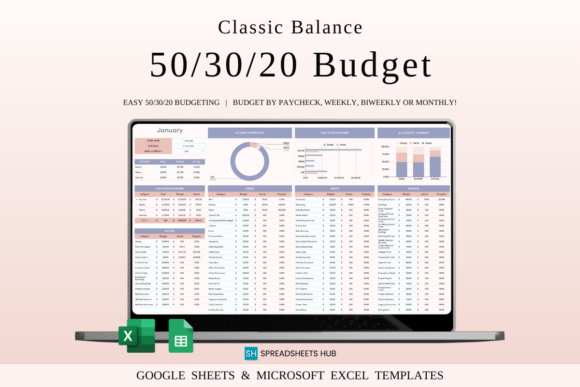

Spreadsheet & Generic Software Bill Trackers: Embrace Your Inner Excel Guru 🤓

For those who love the power and flexibility of spreadsheets, a custom-built bill tracker can be a dream come true. With a little know-how, you can create a system that perfectly matches your unique financial needs. Plus, there’s something satisfying about building your own financial fortress from scratch. 🏰

The Power of Spreadsheets:

- Unleash Your Creativity: Design your spreadsheet to track exactly what you want, the way you want. The possibilities are endless! 🎨

- Customize to Your Heart’s Content: Add categories, formulas, and visual aids to make your bill tracker a work of art. Picasso would be proud! 😉

- Data Security is in Your Hands: Keep your financial information private and secure on your own computer. No need to worry about third-party breaches. 🔒

- Free (or Almost Free): If you already have a spreadsheet program like Microsoft Excel or Google Sheets, you can start tracking your bills right away without spending a dime. 💰

Tips for Creating a Killer Spreadsheet Bill Tracker:

- Start Simple: Begin with the essentials: bill name, due date, amount, and payment status. You can always add more complexity later. 🏗️

- Color-Code Like a Pro: Use colors to highlight upcoming due dates, overdue bills, and paid bills. A visual system makes it easy to spot potential problems. 🚦

- Master Formulas: Use formulas to automatically calculate totals, track spending trends, and generate reports. Excel is your oyster! 🦪

- Explore Templates: Don’t want to start from scratch? Search online for free spreadsheet bill tracker templates to get a head start. 🏃

Spreadsheet bill trackers may require a bit more effort upfront, but the payoff in terms of customization and control can be huge. So, fire up your spreadsheet program and get ready to create a financial masterpiece! 🖼️

Bill Tracker Spreadsheet in Excel

Bill Tracker Spreadsheet in Excel ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Bill Trackers: Cloud & More Digital Platforms ☁️

Cloud-based bill trackers offer a sweet spot between the automation of apps and the customization of spreadsheets. These platforms provide a central hub for managing your bills online, with features like automatic syncing, payment reminders, and budgeting tools.

Why Choose a Cloud-Based Platform?

- Access from Anywhere: Access your bill information from any device with an internet connection. Your finances are always at your fingertips. 🖐️

- Collaboration Made Easy: Share your bill tracker with your spouse, partner, or financial advisor. Teamwork makes the dream work! 🤝

- Automatic Backups: Rest easy knowing your data is securely backed up in the cloud. No more worrying about lost files. 😌

- Integration with Other Tools: Many cloud-based platforms integrate with other financial apps and services, streamlining your workflow. ⚙️

Popular Cloud-Based Bill Trackers:

- Trello: Trello is a project management tool that can be adapted to tracking bills. You can create boards for each month and cards for each bill, moving them from “To Do” to “Done” as you pay them [2].

- Asana: Another project management tool with similar capabilities to Trello. Use Asana to organize your bills, set deadlines, and assign tasks [2].

- Google Calendar: Create repeating events for each bill payment with reminders. This simple method ensures you never miss a due date [2].

- Evernote or Notion: These note-taking apps can be used to create simple bill trackers with checklists and due dates. Keep all your bill-related information in one place [2].

Cloud-based bill trackers are a great option for those who want the convenience of digital tools with a bit more flexibility. Explore your options and find a platform that fits your style. You might be surprised at how much easier managing your bills can be! ✨

Bill Calendar Spreadsheet Template Excel

Bill Calendar Spreadsheet Template Excel ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Bill Tracker Printable Templates & Free Downloads: Back to Basics with a Modern Twist ✍️

Sometimes, the old-school approach is the best approach. Printable bill tracker templates offer a tangible way to manage your finances, without the distractions of screens and notifications. Plus, there’s something satisfying about physically checking off a bill as paid. ☑️

The Charm of Printable Templates:

- Simplicity at its Finest: No need to learn new software or navigate complex interfaces. Just print, fill, and go! 🏃♀️

- Mindfulness and Focus: Paying attention and filling out your payments is a meditative process and helps with memorization.😌

- Affordable and Accessible: Printable templates are often free or very inexpensive. A great option for those on a tight budget. 💰

- Customizable with Flair: Use colorful pens, stickers, and highlighters to make your bill tracker a reflection of your personality. Express yourself! 💃

Where to Find Free Printable Bill Tracker Templates:

- Budgeting Blogs: Many personal finance bloggers offer free printable templates as a resource for their readers [3].

- Online Design Platforms: Canva and other design platforms offer customizable bill tracker templates that you can download and print [3].

- Etsy: If you’re looking for something a bit more stylish or elaborate, Etsy offers a wide variety of printable bill trackers for a small fee [3].

- Google Images: A simple search for “printable bill tracker” will turn up a plethora of free templates to choose from [3].

Printable bill trackers are a timeless classic for a reason. They’re simple, effective, and affordable. So, grab your favorite pen, print out a template, and start tracking your bills the old-fashioned way. Sometimes, the best solutions are the simplest ones! ❤️

Bill Tracker Kdp Planner

Bill Tracker Kdp Planner ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

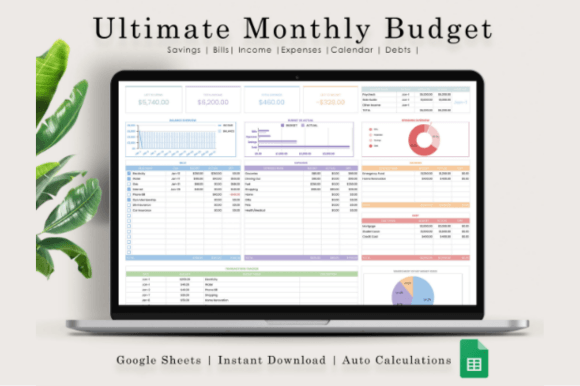

Bill Tracker: Income & General Financial Tools: Get the Whole Picture 🖼️

Tracking bills is just one piece of the financial puzzle. To get a complete picture of your financial health, it’s important to track your income and other financial factors as well. A comprehensive financial tool can help you see where your money is coming from and where it’s going, allowing you to make informed decisions and achieve your financial goals. 🎯

Why Track Income and Other Financial Factors?

- Identify Income Gaps: Are you spending more than you earn? Tracking your income can help you identify gaps in your budget and find ways to increase your earnings. 🔎

- Monitor Your Net Worth: Tracking your assets and liabilities can give you a clear picture of your net worth, helping you assess your overall financial health. 💪

- Plan for the Future: A comprehensive financial tool can help you set financial goals, track your progress, and plan for major life events like retirement or buying a home. 🏡

- Optimize Your Spending: By tracking all your income and expenses, you can identify areas where you’re overspending and find ways to save money. ✂️

Tools for Tracking Income and General Finances:

- Comprehensive Apps: Mint and Personal Capital both offer income tracking and net worth calculation tools in addition to bill tracking.

- Spreadsheet Power-Ups: Enhance your spreadsheet bill tracker with income tracking and net worth calculations. The possibilities are endless!

- Budgeting Software: YNAB and other budgeting programs offer a holistic approach to financial management, including income tracking, bill tracking, and goal setting.

- Professional Advice: Consider working with a financial advisor to get personalized guidance and support. A professional can help you create a comprehensive financial plan tailored to your needs.

Tracking your bills is a great start, but it’s just one piece of the puzzle. By tracking your income and other financial factors, you can gain a deeper understanding of your financial health and make informed decisions that will set you up for success. So, take the time to explore your options and find a tool that meets your needs. Your financial future will thank you! 🙏

Financial Tools | Excel & Google Sheets

Financial Tools | Excel & Google Sheets ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Debt-Free Living: Bill Trackers & Payment Planners: Paving the Way to Freedom 🕊️

If you’re struggling with debt, a bill tracker can be an invaluable tool for getting your finances back on track. By tracking your debts alongside your bills, you can create a clear picture of your overall financial obligations and develop a plan for paying down your debt. Debt-free living is within reach! ✨

How Bill Trackers Can Help You Become Debt-Free:

- Prioritize Your Payments: Use your bill tracker to identify your highest-interest debts and prioritize your payments accordingly. The debt avalanche method can save you money in the long run [4].

- Stay Organized: Keeping track of all your debt payments can be overwhelming. A bill tracker can help you stay organized and avoid missing payments, which can lead to late fees and penalties. 😓

- Track Your Progress: Seeing your debt balances decrease over time can be incredibly motivating. Use your bill tracker to visualize your progress and stay focused on your goals. Keep grinding! 👊

- Identify Savings Opportunities: By tracking your expenses, you can identify areas where you’re overspending and redirect those funds towards debt repayment. Every penny counts! 💰

Debt Payoff Planner & Tracker

Debt Payoff Planner & Tracker ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Payment Planning Strategies:

- The Debt Avalanche Method: Focus on paying off your highest-interest debt first, while making minimum payments on your other debts. This strategy saves you money in the long run [4].

- The Debt Snowball Method: Focus on paying off your smallest debt first, regardless of interest rate. This strategy provides a quick win and boosts your motivation [4].

- Balance Transfers: Transfer your high-interest debt to a credit card with a lower interest rate. This can save you money on interest payments and help you pay down your debt faster [4].

- Debt Consolidation Loans: Consolidate your debts into a single loan with a lower interest rate. This can simplify your payments and save you money in the long run [4].

Debt-free living is a journey, not a destination. But with a bill tracker and a solid payment plan, you can make steady progress towards your goals. Stay focused, stay disciplined, and celebrate your successes along the way. Freedom awaits! 🗽

Debt Snowball SpreadSheet

Debt Snowball SpreadSheet ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

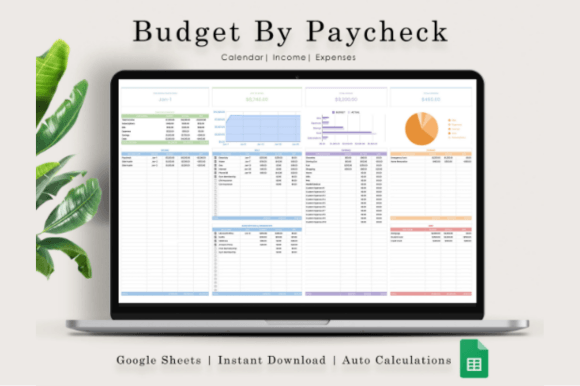

Monthly & Specific Date Bill Trackers: Tailor-Made for Your Calendar 🗓️

Let’s be real, your financial life has a rhythm, and chances are, that rhythm aligns with the calendar. Some bills pop up monthly, others on specific dates. That’s why customizing your bill tracker to match your calendar is pure genius! 😎

The Magic of Monthly Trackers:

- Predictability Rocks: When you know what’s coming each month, you can budget like a pro. No more financial surprises! 😮

- Pattern Recognition: Monthly trackers help you spot spending trends. Maybe you’re splurging on takeout every Tuesday? Time to adjust! 🥡

- Budget Harmony: Sync your tracker with your monthly budget, and watch your financial life fall into sweet harmony. 🎶

Why Specific Date Trackers Are a Must:

- Never Miss a Deadline: Got quarterly or annual bills? A specific date tracker ensures they never slip through the cracks. Say goodbye to late fees! 💸

- Milestone Moments: Birthdays, anniversaries, holidays – these all come with expenses. A specific date tracker helps you plan and save in advance. 🎂

- Financial GPS: Consider it your personal financial GPS, guiding you through the year with key dates and amounts at the forefront. 🧭

Think of a monthly tracker as your consistent heartbeat and the specific date tracker as your important reminders for your overall finance health. 🧑⚕️ Whether you’re a digital devotee or a pen-and-paper person, tweaking your bill tracker to align with your calendar is a game-changer! 🕹️

Monthly Bill Calendar Spreadsheet Excel

Monthly Bill Calendar Spreadsheet Excel ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Yearly & Annual Bill Tracking Formats: The Big Picture Perspective 🔭

While monthly and specific trackers help you in the short term, let’s zoom out and view the entire horizon! Yearly and annual bill tracking formats provide an overview, allowing you to look back, access and optimize. If you’re into the 30,000-foot view of your financial life, then annual bill tracking is your jam. 🫙

The Power of the Yearly View:

- Long-Term Insights: Spot trends you’d miss in a monthly view. Are your energy bills always higher in winter? Time to investigate insulation! 🕵️♀️

- Annual Budget Check: Did you stick to your annual financial goals? The yearly tracker is your report card. 📝

- Tax Time Simplified: Easily access your total spending for tax-deductible expenses. Accountants love you! 🥰

How to Rock the Annual Tracking Format:

- Choose Your Weapon: Spreadsheet, app, or printable? Pick the format that suits your style, and stick with it all year. 💪

- Categorize Cleverly: Break down your spending into meaningful categories, such as housing, transportation, and entertainment. 🗂️

- Review Regularly: Set aside time each quarter or month to review your annual tracker and make adjustments as needed. No slacking! 🦥

Yearly and annual bill tracking isn’t about micromanaging every penny. It’s about seeing the forest for the trees and making informed decisions that set you up for long-term financial success. It’s the difference between a captain navigating by stars and sailing blindly. It can transform financial well being by preparing for major decisions, making you able to boldly take on mortgages or big purchases! 💯

Annual Budget Spreadsheet Template Excel

Annual Budget Spreadsheet Template Excel ✓ Click here and download ✓ Window, Mac, Linux · Last updated 2025 · Personal, Commercial and POD use of files included ✓

Ready to Level Up Your Finance Game? 🚀

So, there you have it – the ultimate guide to bill trackers! From digital apps to printable templates, there’s a solution out there for everyone. The key is to find a system that works for you and stick with it. Consistency is the name of the game. Remember that being financially responsible does not happen overnight. With persistence and dedication, this system can make bill-managing a breeze!

Now that you’re armed with the knowledge and tools you need to conquer your bills, it’s time to take action. Start exploring the different options, experiment with different methods, and find a bill tracker that fits your unique style. Your financial future is waiting!

Ready to dive even deeper into the world of personal finance? Click here to visit our website and discover a treasure trove of resources, tips, and tricks to help you achieve your financial goals!